Argo AI will outfit its entire testing fleet with new lidars based on Geiger-mode sensing technology before the end of this year.

Argo AI this week teased a few details of its lidars based on Geiger-mode sensing, a relatively uncommon technology. The company will outfit its entire testing fleet (roughly 200 vehicles) with the new lidars before the end of this year.

The self-driving car developer (Pittsburgh, Penn) uses avalanche photodiode technology originally developed by Princeton Lightwave (Cranberry, NJ), which Argo acquired in 2017, complete with its IP, technology and its team of more than fifty engineers.

For years, Argo has kept a tight lid on the progress with the Princeton Lightwave deal. Argo’s lidar also proves that the automotive lidar market remains deeply in flux. None of the leading autonomous vehicle companies — including Waymo, Aurora, Cruise and Argo — is betting its future on off-the-shelf lidars. (Many, however, have been using Velodyne’s lidars, spinning on the rooftops of their test vehicles.)

How Stanley Electric’s IR LEDs and VCSELs Contribute to High-performance Driver Monitoring Systems

Rather, they have opted to design lidars of their own. However, among the leading AV developers, lidar technologies are all over the map, in terms of lidar physics (e.g., linear time of flight, ToF with photon counting detectors, frequency-modulated continuous-wave), operating wavelengths (850nm – 940nm, 1400nm -1550nm), and field of view (flash versus scanning).

No single winning technology has yet emerged.

RecommendedLidar Sweepstakes Draws 15 RFQs, But No Frontrunner

Knowing trade-offs

In an interview with EE Times, Zach Little, senior director of hardware and firmware development at Argo AI, described Argo lidar as “unique.” He cited three factors: the use of a wavelength above 1400nm, a single photon, and a 360-degree horizontal field of view.

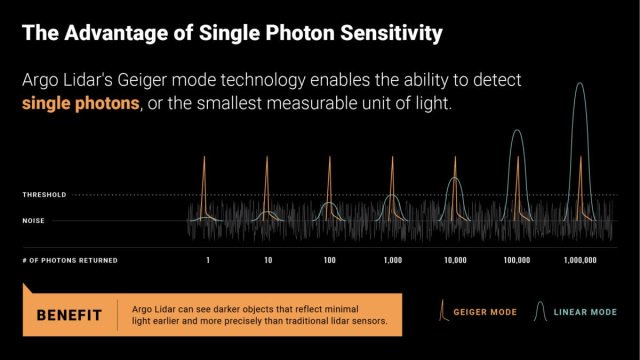

A single photon generated by Argo’s Geiger-mode lidars is critical to sensing objects with low reflectivity, according to Argo. Operating at higher wavelength, above 1400nm, gives longer range and higher resolution.

A full field of view is also important, added Little. While Argo’s lidar is a ToF flash lidar, it sits on top of a mechanically rotating pedestal, giving it a 360-degree horizontal field of view.

To Argo’s credit, the company isn’t pitching its lidar as a panacea. Little acknowledged compromises are inherent in the technology. In his opinion, in developing lidars, it is vital that the self-driving car’s perception team know exactly the perception problems it wants a lidar to solve, as well as the tradeoffs necessary to the solution.

Dark targets

It turns out that detecting dark targets, like black cars, is a challenge for most lidars.

For example, if the target is a white car, 80 percent of the light hit by a lidar will come back. “But there are dark cars in the market that less than 1% of the light comes back,” said Little.

That got Argo thinking of what happens in an unprotected left turn and you want to see if there’s a car coming. “Being able to see a 10 percent target at 200 meters wouldn’t help you,” he said. In developing its lidar, Argo’s team determined that its lidar should be able to see dark targets even when those targets are still farther up the road.

Pierrick Boulay, market and technology analyst at Yole Développement (Lyon, France), told EE Times, “Reflectivity of object is key for all lidar manufacturers. This is linked to the detection range.” But using “single photon detection,” as in Argo’s lidar, could “improve the detection, even for low reflectivity objects,” he added.

A case in point is a demo carried out at the 2019 Frankfurt Motor Show. BMW painted its X6 “Vantablack” which has reflectivity around 1 percent, said Boulay. “Ouster tested its lidar on this car. The outcome [in its PR stunt] was that the lidar still saw the car, but the detection range was reduced.”

Why go above 1400nm?The use of wavelength above 1400nm in Argo’s lidar also contributes to its ability to see dark targets. Higher wavelength is “the biggest knob you have to determine how much [light] you can get back off the target,” explained Little.

The majority of lidar makers are using 905nm, but 1550nm is “gaining momentum today,” observed Boulay.

Longer wavelengths are in the works at Luminar, AEye, Cruise, Baraja, Aurora (previously Blackmore), Scantinel Photonics (Ulm, Germany), Innovusion (Sunnyvale, Calif.), or SiLC (Monrovia, Calif.), he noted, although the list isn’t exhaustive. Boulay sees that 1550nm will be increasingly deployed for lidars using silicon photonics.

Yole’s Boulay added that one of the main advantages of long-wavelength lidar is “related to eye safety.” Since longer wavelength lidar solutions can safely emit more laser energy than short wavelength lidar, they can achieve longer sensing distances while still being eye-safe.

Dense dataset

Is Argo’s lidar the only one using Geiger-mode?

Boulay said, “As far as we know, few lidar manufacturers are using Geiger-mode lidar.” The technology is used in airborne applications to collect elevation data points across large areas by a company called L3Harris, he added.

Before the acquisition by Argo, Princeton Lightwave was developing lidars for military/aero applications.

What then is the biggest advantage of Geiger-mode?

Its ability to provide “a very dense dataset,” Boulay pointed out. Geiger-mode lidars use a lower energy laser pulse than linear mode lidar, but the pulse rate is much higher, he explained. “As far as we understand the technology, its advantage is in its sensitivity,” producing higher resolution images.

According to Little, with rapid pulsing, Argo lidar can capture images invisible to other lidars, “such as a chain link fence or powerlines.”

“This makes a huge difference,” said Little. “If the legacy lidar had lidar points — 15 points on 20 points — on the human, our lidar has lidar landing, 70, 80, 150 points on him. This makes it a lot easier to identify a person.”

Wouldn’t this generate too much data for the perception system to process?

We can handle it, said Little said, because “if you compare a lidar to cameras, the lidar still generates much lower resolution.”

Geiger-mode technology does have limitations.

“High-sensitivity detection provided by Geiger-mode lidar leads to lower SNR,” or signal to noise ratio, Boulay pointed out, as “Some noise could come from dark current, crosstalk, solar background.” Thus, the Argo’s lidar “would require advanced de-noising algorithms,” Boulay surmised.

Use case of the lidar

Argo’s business is squarely committed to developing Level 4 self-driving vehicles.

Argo, with backing from Ford and Volkswagen, will offer shared fleets designed for ride-hailing and goods delivery. Ford and Volkswagen are Argo’s investors and partners, and they are also Argo’s first customers.

As many independent lidar companies shift their target markets to ADAS vehicles or other industrial applications (i.e. factory floors, mining, agriculture), Argo’s lidar remains focused on enhancing the perception of Level 4 vehicles.

Argo’s spokesman made it clear that Argo’s self-driving vehicles won’t be just tooling around at 25 miles an hour in quiet suburbia. “That would not be too useful,” he said. Argo’s vehicles are intended to not only drive on highways but also on higher-speed suburban boulevards. He referred to densely populated areas where self-driving cars are expected to drive at 50 miles per hour, in neighborhoods lined with restaurants, big box stores, where pedestrians share the turf with high-speed moving cars.

Given that Argo’s self-driving cars drive at highway speeds — 60 or 65 miles per hour, Argo lidar must have a range of at least 250 meters, said Little. “Two hundred meters is simply not enough. You need to be able to see further to drive safely at those speeds.”

Manufacturability

Notably, many new captive lidars are still in development. Most aren’t close to volume production.

Cruise, for example, bought a solid state lidar startup Strobe (Calif.) in 2017. Aurora, which already snatched up Blackmore, a Montana-based frequency-modulated continuous-wave (FMCW) lidar developer, in 2019, acquired yet another lidar company, Ours Technology, earlier this year. It’s a small lidar company founded by a team of University of Calif.-Berkely Ph.D.’s.

Neither have disclosed technical details or production plans.

The only exception might be Waymo’s Honeycomb lidar. Waymo’s short-range lidar is based on mechanical technology, featuring a rotating mirror and turntable. The company has made it commercially available to non-automotive companies. But Waymo isn’t standing still.

RecommendedWaymo’s Lidar Plan: How’s It Working out?

In an interview with EE Times, Waymo revealed that it has explored “coherent lidars” as a technology option. This is an FMCW lidar. The progress of Waymo’s FMCW development, however, remains unknown.

Argo’s Little stressed during the interview that Argo is mindful of manufacturability issues. For example, he noted, “as you go up in wavelength, you have to get slightly more exotic with materials.” Nonetheless, he pointed out that Princeton Lighwave, when Argo acquired it, had been selling its lidars since the early 2000s. With lots of IP around the photodiode area, “They know how to design them and how to manufacture them,” said Little. “They weren’t a flash-in-the-pan company.”

Avalanche photodiodes used in Argo’s lidar are fabricated by an unnamed foundry based in Taiwan, according to Little. The final lidar system will be built by an equally undisclosed manufacturing partner.

Unlike “a number of [lidar] companies who have underestimated the significance of manufacturability,” Little expressed confidence that production of Argo’s lidar will scale from the current volume of hundreds to thousands. “It was really part of our plan.”