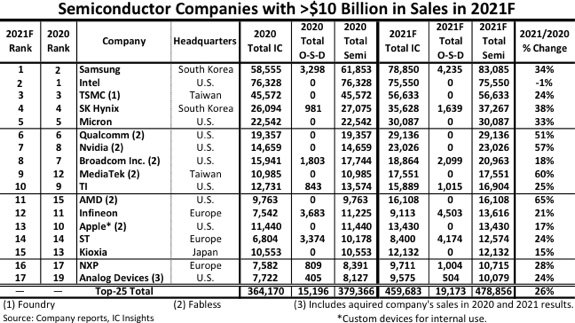

With its $83 billion sales, Samsung tops list of 17 semiconductor companies with expected sales of greater than $10 billion in 2021.

With expected semiconductor sales of $83 billion in 2021, Samsung will displace Intel in the top spot of 17 companies, or “megasuppliers,” expected to have greater than $10 billion sales in 2021. The list includes six fabless companies (Qualcomm, Nvidia, Broadcom, MediaTek, AMD, and Apple) and one pure-play foundry (TSMC).

The figures compiled by IC Insights look at companies’ forecasts of worldwide semiconductor (IC and OSD — optoelectronic, sensor, and discrete) sales of greater than $10.0 billion in 2021. These megasuppliers include nine suppliers headquartered in the U.S., three in Europe, two in Taiwan and South Korea, and one in Japan. Three semiconductor companies — AMD, NXP, and Analog Devices — are expected to join this noteworthy list in 2021.

In total, the megasuppliers’ sales are expected to jump by 26% in 2021 compared to 2020. Growth rates among the 17 companies are expected to range from AMD’s 65% to Intel’s -1%. Four companies — AMD, MediaTek, Nvidia, and Qualcomm — are forecast to post a sales gain of greater than 50% for 2021.

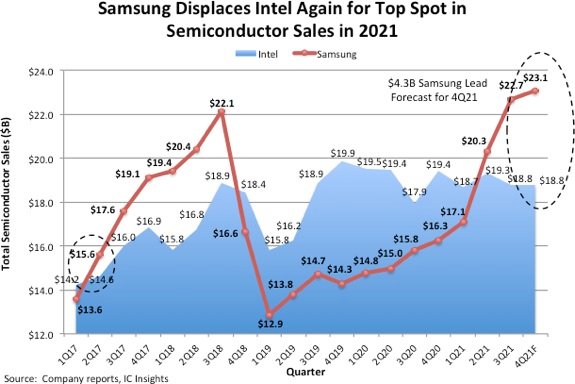

Samsung’s semiconductor sales are forecast to be nearly $83.1 billion in 2021, making it the largest semiconductor supplier this year. IC Insights said this is driven by a resurgent memory market and relatively flat sales results from Intel, enabling Samsung to once again replace Intel as the leading semiconductor producer beginning in 2Q21. With the DRAM market NAND flash markets showing strong growth in 2021, Samsung is forecast to register a 34% increase in 2021/2020 sales and open up a $7.5 billion lead over second-ranked Intel.

In order to make the year-over-year growth rate comparisons more reflective of actual growth, the sales figures include each company’s semiconductor sales from acquisitions in 2020 and 2021 regardless of when the acquisition was finalized.

For example, Analog Devices officially closed its deal to acquire Maxim on August 25, 2021. However, IC Insights added Maxim’s full-year 2020 IC sales of $2,354 million to Analog Devices’ 2020 semiconductor sales for a total of $8,127 million. In addition, $665 million was added to Analog Devices’ 1Q21 sales to account for Maxim’s 1Q21 revenue with another $720 million added to Analog Devices’ 2Q21 sales to reflect Maxim’s semiconductor sales in that time period. Since the deal was finalized at the end of August, about two-thirds the way through 3Q21, $500 million in sales was added to Analog Devices’ 3Q21 sales. With these adjustments, Analog Devices’ 2021/2020 semiconductor sales are forecast to jump by 24%.

This article was originally published on EE Times.

Nitin Dahad is a correspondent for EE Times, EE Times Europe and also Editor-in-Chief of embedded.com. With 35 years in the electronics industry, he s had many different roles: from engineer to journalist, and from entrepreneur to startup mentor and government advisor. He was part of the startup team that launched 32-bit microprocessor company ARC International in the US in the late 1990s and took it public, and co-founder of The Chilli, which influenced much of the tech startup scene in the early 2000s. He s also worked with many of the big names—including National Semiconductor, GEC Plessey Semiconductors, Dialog Semiconductor and Marconi Instruments.