The two will establish a subsidiary to provide production at "specialty" nodes of 28nm and 22nm by the end of 2024.

Taiwan Semiconductor Manufacturing Co. (TSMC) and Sony will join as investors in a chip facility in Japan to address strong demand for specialty technologies at the 28nm and 22nm process nodes, the companies said in a joint statement.

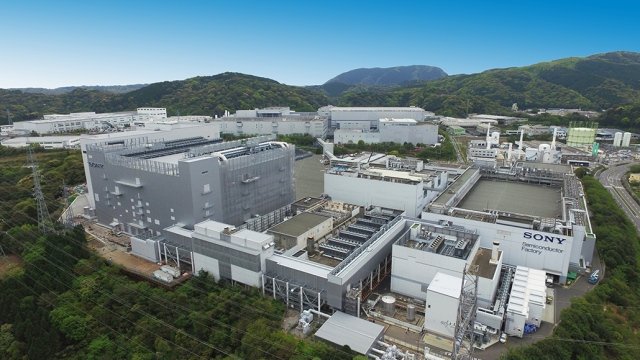

Sony Semiconductor Solutions and TSMC will establish a subsidiary, Japan Advanced Semiconductor Manufacturing Inc. (JASM), in Kumamoto, Japan to provide foundry services by the end of 2024.

The fab is expected to employ about 1,500 people and reach a monthly production capacity of 45,000 12-inch wafers. The initial capital expenditure is estimated to be approximately $7 billion with the Japanese government providing an undisclosed amount of subsidies.

Sony plans to make an equity investment in JASM of a half billion dollars, which will represent a less than 20 percent equity stake in the new venture.

“We are pleased to have the support of a leading player and our long-time customer, Sony, to supply the market with an all new fab in Japan, and also are excited at the opportunity to bring more Japanese talent into TSMC’s global family,” TSMC CEO CC Wei said in the statement.

The planned investment in Japan came so quickly that it is not included in the $100 billion that TSMC earlier this year said it plans to spend for capacity expansion in the next three years.

TSMC’s Japan fab adds to a decades-long long history in Japan’s semiconductor ecosystem. The company set up its first Japan subsidiary in 1997. More recently, TSMC established the Japan Design Center in 2019, and the company is working with Japanese partners to expand the frontiers of advanced packaging technology with the 3DIC Research Center in Ibaraki Prefecture.

“While the global semiconductor shortage is expected to be prolonged, we expect partnership with TSMC to contribute to securing a stable supply of logic wafers, not only for us but also for the overall industry. We believe that further strengthening and deepening our partnership with TSMC, which has the world’s leading semiconductor production technology, is extremely meaningful for the Sony Group,” said Terushi Shimizu, President and CEO of Sony Semiconductor Solutions.

Governments around the world are demanding a secure supply of semiconductors as their domestic automakers continue to idle production lines because of chip shortages. Those governments are seeking manufacturing investments from leading chip makers in Asia such as Samsung of South Korea and TSMC of Taiwan, as well as Intel of the U.S.

TSMC has been building a new 5-nm chip facility in the U.S. state of Arizona. While most of TSMC’s production is in Taiwan, the company operates one 12-inch “gigafab” as well as an older 8-inch facility in China and an older 8-inch facility in the U.S.

The fragility of the semiconductor supply chain became more apparent this year as accidents worsened global shortages. Renesas of Japan had a fire in one of its facilities earlier this year while Samsung, Infineon and NXP were forced to halt production in Austin, Texas after a freak winter storm halted supplies of electricity.

This article was originally published on EE Times.

Alan Patterson has worked as an electronics journalist in Asia for most of his career. In addition to EE Times, he has been a reporter and an editor for Bloomberg News and Dow Jones Newswires. He has lived for more than 30 years in Hong Kong and Taipei and has covered tech companies in the greater China region during that time.