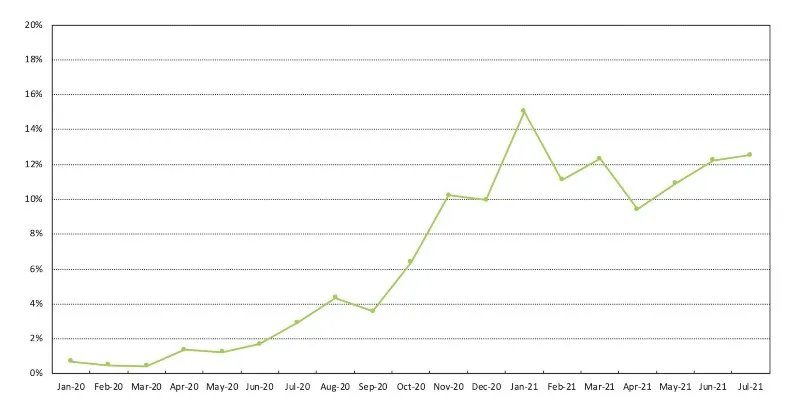

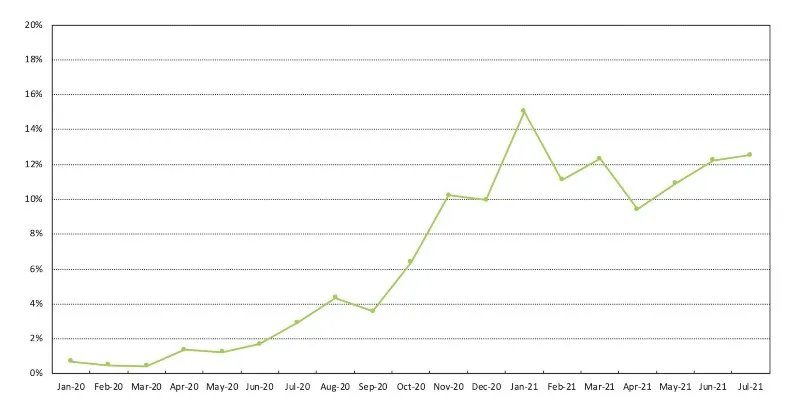

The share of LFP battery in the global EV market is expected to reach a new high in Q4, up from 13% in July 2021, mainly driven by shipments from GM, BYD and Tesla.

According to the Worldwide Monthly BEV PHEV Tracker from Researcher and Research LLC, the share of lithium-iron-phosphate (LiFePO4 cathode; LFP) battery in the global electric vehicle (EV) market (in terms of MWh) was 13% in July 2021, as shown in Figure 1. We expect a new high share in the fourth quarter this year, mainly driven by shipments from GM (Wuling), BYD and Tesla.

Figure 1: Share of LFP battery in global EV market.

SCHURTER Leading the Way Towards Greener Electronics Manufacturing

Mainly produced and sold in China

Nearly 100% of current EV models using LFP battery are manufactured and sold in the Chinese market. In terms of EV sales from January to July this year, the rise in the proportion of LFP battery was mainly driven by models such as GM Wuling HongGuang Mini, Tesla Model 3, BYD Han, BYD Qin Plus DM-i, BYD Qin Plus and Sol E10X.

Currently, only Chinese battery manufacturers are licensed to manufacture and sell LFP battery in China, as a series of patents for LFP battery are held by a consortium of Chinese research institutions. In addition, the performance of early LFP battery was seriously behind that of NMC and NCA batteries. As a result, only Chinese battery manufacturers produce LFP battery, and they were all used in the e-bike and low-end EV markets. As for major battery manufacturers outside China, there is no desire to produce LFP battery, because not many automakers are willing to adopt it.

For example, before 2020, BYD was the world s largest supplier of LFP battery, mainly for the group s own use, and the only customer outside the group was Daimler AG from 2015 to 2017. Besides, Hefei Guoxuan s main customers were only JAC Motors and BAIC, and Optimum Nano briefly supplied its LFP battery to Hawtai Motor Group from 2018 to 2019.

Reasons for rising demand for LFP battery

It was not until 2019 that the demand for LFP battery gradually became stronger, mainly due to the relatively mature development of BYD s blade battery and CATL s cell-to-pack (CTP) technology, allowing LFP battery to improve energy density and significantly reduce range anxiety. Moreover, corresponding solutions for the decrease of range caused by low temperature environment have also emerged.

We expect that the proportion of LFP battery used in EV will continue to rise in the future, mainly because of their long battery life, not containing scarce raw materials such as nickel and cobalt, and relatively low cost. Although the energy density is lower than that of nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) batteries, at this stage, the ability to significantly reduce the cost of EV is the key to stimulate the growth of market demand.

In this regard, we can see more and more EVs in the Chinese market using LFP battery to achieve the goal of increasing market size at a lower price. Examples of significant growth in sales of such models include: (1) GM Wuling HongGuang Mini; (2) Tesla Model 3 produced at Gigafactory Shanghai; (3) BYD Han, BYD Qin Plus DM-I and BYD Qin Plus, all of which adopt its own battery cells; (4) JAC Motors Sol E10X; (5) Great Wall Ora R3 / Good Cat; (6) GAC Aion Y; and (7) Xiaopeng Xpeng P7.

In addition, Tesla announced on August 27 that customers of the North American Model 3 Standard Range Plus will be able to opt for LFP battery packs for a faster delivery schedule. Moreover, Ford, VW Group and Stellantis have also publicly stated that they will use LFP battery in commercial and entry-level models.

Apple, which has been repeatedly rumored to enter the auto industry, may also be a proponent of LFP battery. According to Reuters, Apple considers to use lithium iron phosphate and new battery design of monocell.

Coupled with the previous battery fire incidents of Hyundai Kona/Ioniq and GM Chevrolet Bolt EV/EUV, the safety of battery has been highlighted. Therefore, under the dual consideration of cost and safety, the incentive for automakers to choose LFP battery at present is even stronger.

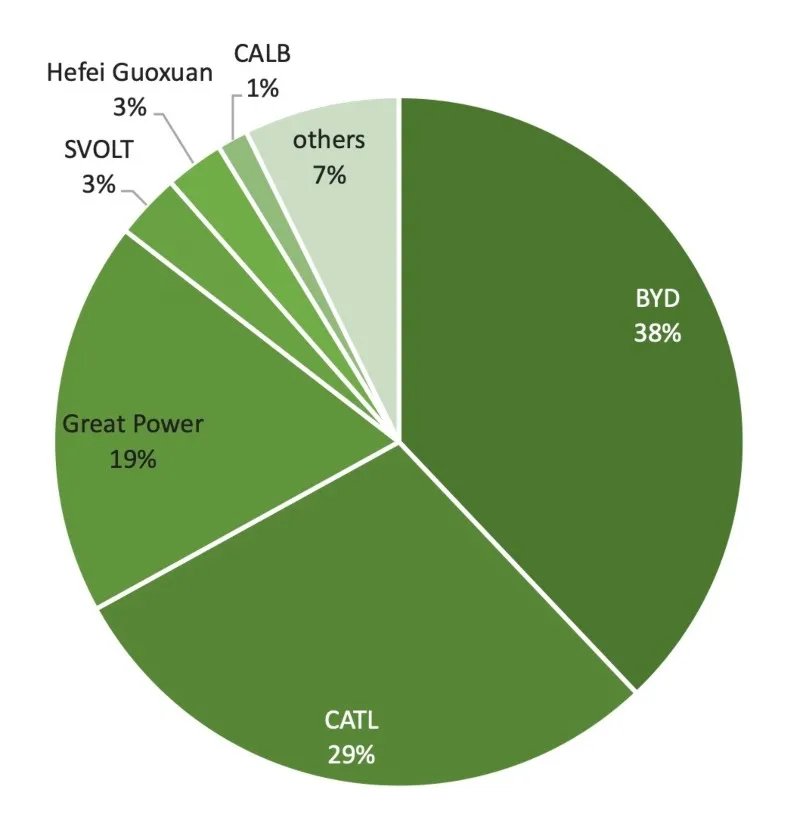

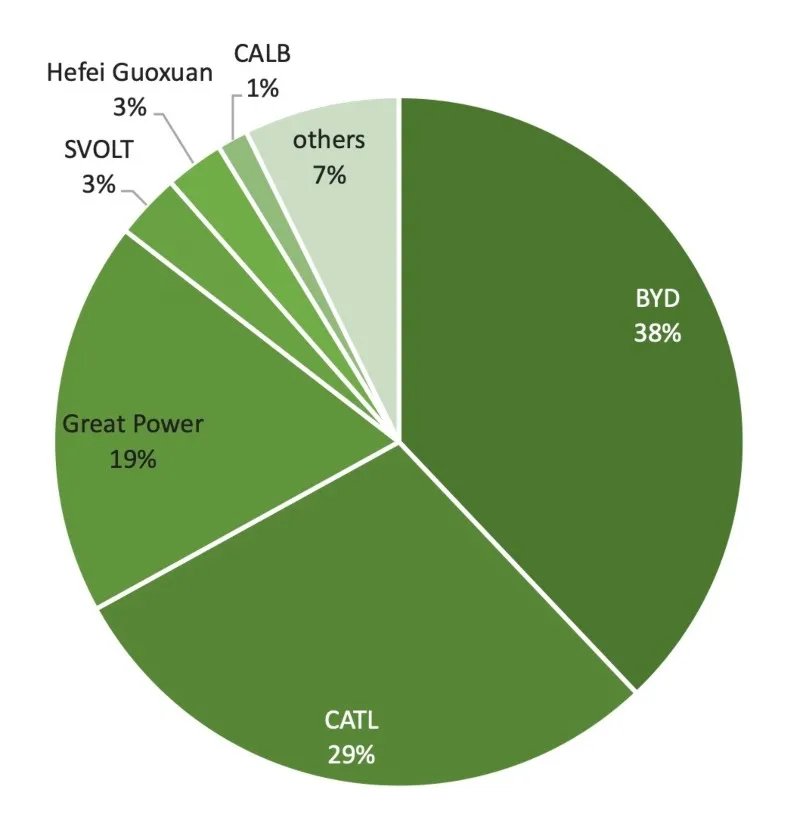

Current major suppliers of LFP battery

BYD, CATL and Great Power are currently the big three LFP makers which accounted for 86% of the market, as shown in figure 2. BYD mainly supplies its own EV, with a small portion supplies to FAW, while CATL has Tesla as its largest client and Xiaopeng as a new one this year, and Great Power has GM as its main customer.

Figure 2: Market share of LFP battery manufacturers for EV, January-July 2021.

Currently, LG Energy Solution has plans for the production of LFP battery. In the future, there may be plans for battery manufacturers in Europe or North America in this regard. As a result, we believe that the production of LFP battery will not be limited to Chinese manufacturers.

Due to the relatively cheap positioning of LFP battery, it is beneficial for automakers to stimulate the growth of EV market demand. This makes LFP battery surging in the EV market, but it also makes the fate of LFP battery be determined. Because of the inherent technical limitations of LFP battery, in the face of continuous development of other battery materials and the successive innovation of competing technologies, LFP battery with cost advantages must be ahead of other battery technologies to reduce their costs again and again, and the cost competition among LFP manufacturers will always exist.

Note: Researcher and Research here defines EV as battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV), with passenger car (including light commercial vehicles (LCV)) as the primary purpose.

About the Author

Dr. Y.-C. Hsu is the co-founder and CEO of Researcher and Research LLC, a market research firm focused on the electric vehicle (EV) market. For more information, visit https://thernrcorp.com.